Why do campaigns have spread limits?

KB: 0046

The issuers run liquidity mining campaigns to reduce slippage: i.e. make their tokens be more easily tradable by the market. This means having maker orders in the order book at better prices (tighter spreads) and larger sizes so that it's more efficient for the market to trade. Orders at wider spreads do not contribute as much to slippage because they are less likely to be filled and executed.

Therefore, issuers running campaigns don't want to incentivize orders at wider spreads because they have a lot less utility and benefit for the market.

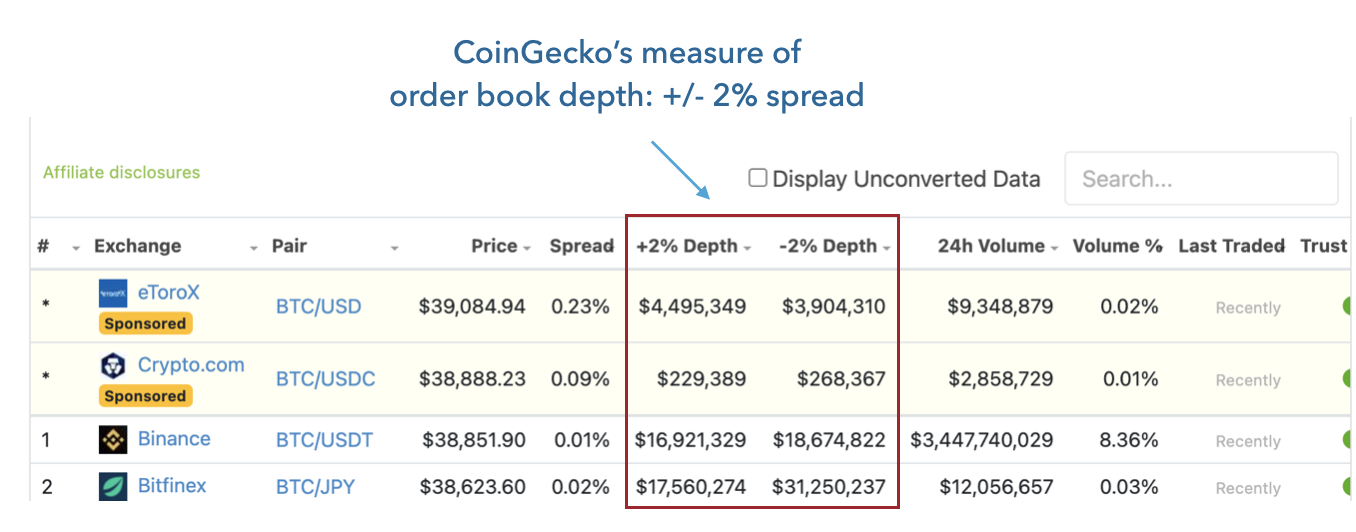

By default, many issuers use 2% as a max spread because this also corresponds with Coingecko's measure of order book depth.