Liquidity Mining Explained

KB: 0003

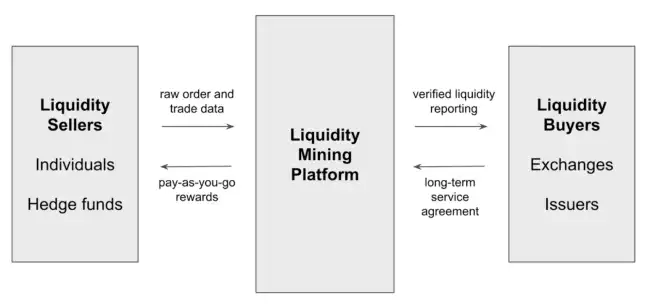

Hummingbot Liquidity Mining is a decentralized, community-based market making. It allows anyone (communities, the general market) to participate in market making for a token and contribute to its liquidity and improve the tradability of that token. By participating, users are not only helping to support the token and the project, but through liquidity mining, they are able to earn token rewards based on their trading activity.

Open (Anyone can participate)

Real-time (Track your earnings every minute)

Non-custodial (We don't have access to your tokens)

Here's a short 1-minute video that explains Liquidity Mining:

While this video below has more in-depth explanation for new users:

We call this Liquidity Mining because the concept is similar to proof-of-work mining. Rather than setting up a mining rig and using electricity, users utilize computational power and token inventory to run the Hummingbot market making client. By competing with other participants to earn economic incentives, their combined efforts can achieve a common goal, providing liquidity for a specific token and exchange. In return, they are compensated proportional to their work, according to an algorithmically defined model.

For more information, please read the Liquidity Mining Policy.