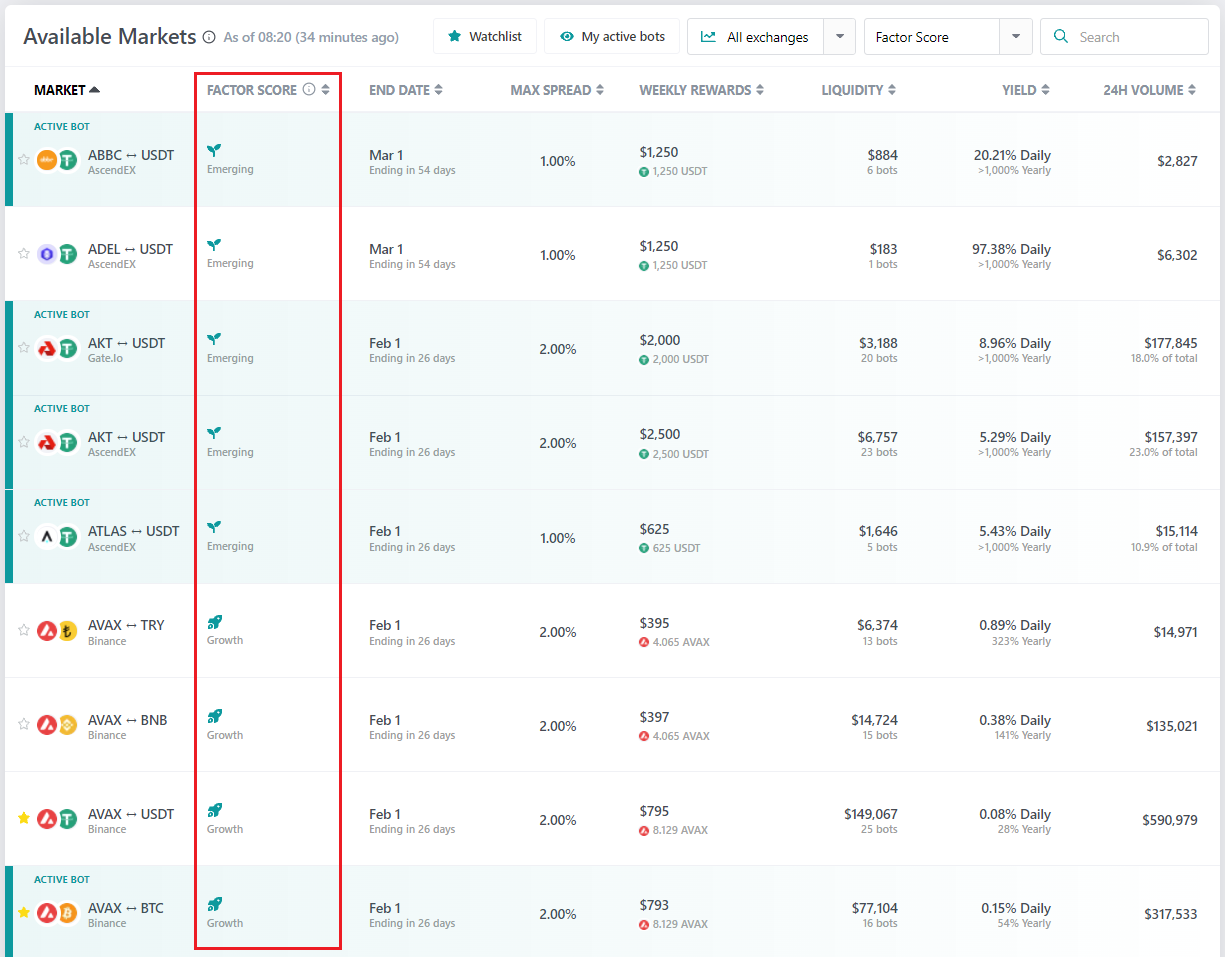

Factor Score: What is it and how should I use it?

KB: 00014

The Factor Score aims to convey the risk faced by liquidity providers for a given token. Based on publicly verifiable data points such as market capitalization rank and number of days since first publicly listed, a specific quantitative measure is calculated for each token. Afterward, the token is assigned to one of the following bands:

-

Stable: Stablecoins. Given the nature of these tokens, volatility is extremely low for trustworthy issuers. They are a good option for beginners to get acquainted with market-making since there is less need to manage inventory or worry about sudden price movements. Spreads tend to be the tightest, so P/L may depend on the difference between rewards earned versus fees paid.

-

Core: Well-established tokens with a long track record and highly-ranked market capitalizations fall in this category. This translates into tighter spreads but lowers volatility when compared to less seasoned tokens. Also a good starting point for beginners.

-

Growth: This is an intermediary category of tokens that may have shorter track records or lower market capitalization. They may exhibit higher volatility and risk than Core tokens but may also have higher yields and fewer bots.

- Emerging: New or recently issued tokens tend to fall in this category. Due to their short history, liquidity is the lowest when compared to the other categories, making them prone to sudden price movements and price gaps. Recommended for more advanced miners.

Info

Please consider each token’s Factor Score when choosing which market you will provide liquidity to, and make sure it matches your skill level and risk preferences.